Kohl’s shares pop on takeover interest from Sycamore

Kohl’s is being courted, and that’s turbocharging its shares on Monday. Reuters reported Sunday that Sycamore Partners had approached the department store chain with a potential takeover offer of $9 billion.

The private equity firm is willing to pay at least $65 a share. That’s a 39% premium to Kohl’s last closing price. And it’s a buck more than last week’s offer from Acacia Research, which is backed by activist investment firm Starboard Value.

Kohl’s on Monday confirmed it has received letters expressing takeover interest, saying its board would review them. But it did not name the suitors.

Some analysts think Kohl’s is worth even more - as high as $80 a share - and that other bidders could jump into the fray.

All the interest swirling around Kohl’s drove its shares up by more than a third in early trading Monday, and it boosted those of rivals Macy’s and Nordstrom’s as well.

Analysts have applauded Kohl’s for its moves to partner with the likes of Sephora and Calvin Klein after it lost market share to off-price and online chains. But the market hasn’t been giving it credit with shares rising just 5% last year, and activist investors have pressured the chain to explore options that include a sale.

相關影片推薦

1:51

凌晨2點32分花蓮大地震全台驚醒 規模6.3富凱飯店倒了民視影音170,501 次觀看・9 小時前1:30

嗆中駐美大使「雙手沾血」! 哈佛學生遭起底是台灣人|#鏡新聞鏡新聞99,224 次觀看・18 小時前1:39

"亮警證"幫女友家人喬車位 內湖分局將懲處員警民視影音263,920 次觀看・1 天前1:50

花蓮港震後潮差大! 港口水位「剩不到3米」船恐觸礁華視影音40,836 次觀看・19 小時前 1:41廣東「百年一遇」暴雨強襲 橋梁瞬間崩塌 空拍看水鄉澤國、土石流覆蓋山坡Yahoo奇摩(國際通)81,074 次觀看・21 小時前

1:41廣東「百年一遇」暴雨強襲 橋梁瞬間崩塌 空拍看水鄉澤國、土石流覆蓋山坡Yahoo奇摩(國際通)81,074 次觀看・21 小時前1:25

掛身障車牌停"專用車位"遭罰!民眾氣炸申訴 警坦承疏失撤單民視影音2,385 次觀看・20 小時前1:55

徐巧芯指早餐店日賺2萬 四叉貓質疑沒開發票民視影音8,157 次觀看・8 小時前3:31

追不到砍她176刀致命 王鴻偉拖15年未槍決華視影音328,212 次觀看・2 天前1:44

凌晨規模6連2震!花蓮統帥大樓「軟腳傾倒」 住戶親曝人員現況民視影音2,989 次觀看・10 小時前 4:09一分鐘報天氣 / 週二 (04/23) 鋒面南下至臺灣 未來一週天氣不穩定留意局部大雨Yahoo奇摩新聞(報氣象)10,333 次觀看・20 小時前

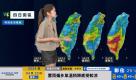

4:09一分鐘報天氣 / 週二 (04/23) 鋒面南下至臺灣 未來一週天氣不穩定留意局部大雨Yahoo奇摩新聞(報氣象)10,333 次觀看・20 小時前

熱門必看

14:01

邱宇辰、黃宏軒演出腐女心中的幻想!超禁忌兄弟戀讓唐老師興奮到模糊!?Ep.215-1唐綺陽談星室32,066 次觀看・1 天前24:07

【小瑜星座】高段位愛情專家 令人震撼的雙魚女雷達之星3,425 次觀看・3 天前19:54

跑步一定又喘又累?不會累的 #超慢跑,該怎麼跑才能控糖、減脂?ft. 超慢跑教練 徐棟英老師 @tongyinghsu 《 強者我朋友 》|志祺七七志祺七七 X 圖文不符2,150 次觀看・2 天前26:20

【東京近郊景點】栃木那須高原✨距離東京1小時!絕景森林步道、生起司蛋糕CHESSE GARDEN、沼原濕原、那須彩繪玻璃美術館、那須溫泉神社、殺生石、那須動物王國|東京自由行・Japan 4Kvlog吉田社長交朋友1,257 次觀看・1 天前1:08

周慧敏 倪震夫婦罕同框 舉止親密力破婚變傳聞娛樂星聞16,494 次觀看・3 天前

Yahoo TV

Yahoo TV